What is the Health and Social Care Levy?

The levy will be a 1.25% tax on earnings for employees, the self-employed and employers and will apply from April 2022 onward.

The tax will be applied in the same way as National Insurance Contributions (NIC's) however the levy will also apply to those over State Pension age.

The levy is expected to raise around £12bn extra each year in taxes which will will be “hypothecated in law to health and social care”. Essentially ringfenced for health and social care.

HMRC's info can be seen here

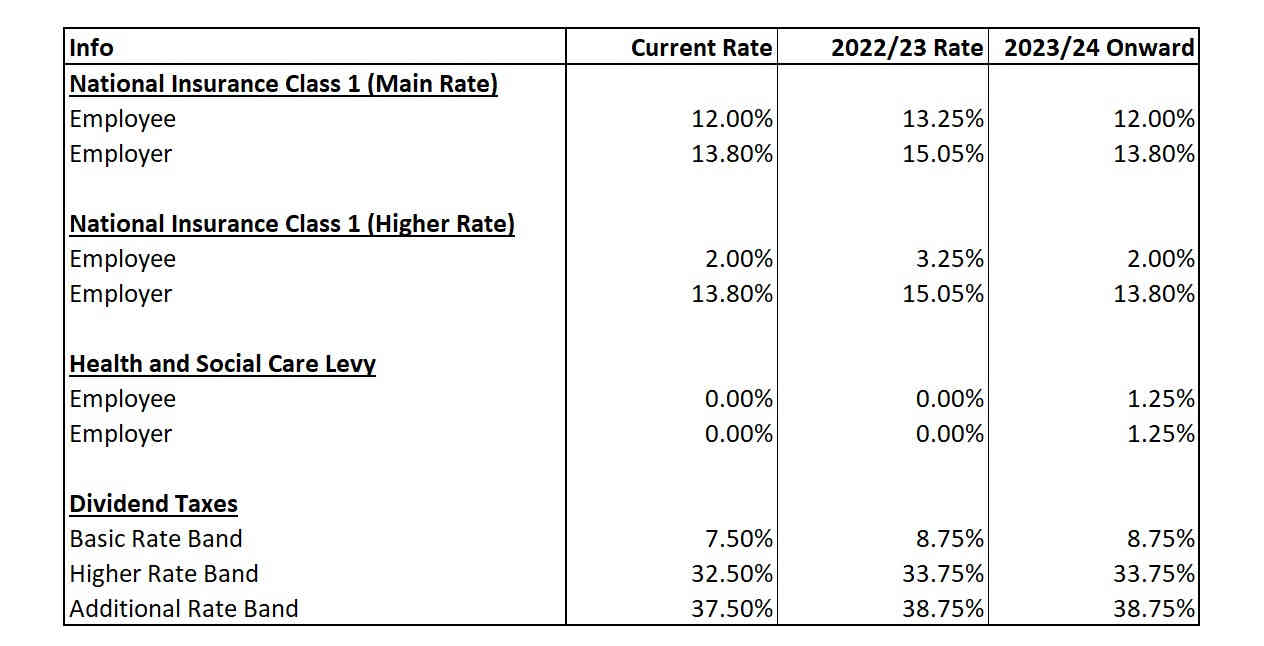

Levy Rates

The tables below show the rates that will be applied to earnings within the NIC bands.

There are also details as to the changes in the dividend tax rates as part of the changes.

I'm over State Pension Age, am I affected?

Yes. Unlike National Insurance, the 1.25% increase will affect any employment or self employment earnings from April 2023 onward.

However, as the increase between 6th April 2022 and 5th April 2023 is being temporarily included in the National Insurance calculations, anyone over State Pension age won't be affected by the Levy during that year.

Are self-employed affected?

Yes. the table above only shows the rates applied to employment earnings however the 1.25% increase will also apply to the Class 4 National Insurance paid by self-employed.

The Class 4 NIC rate for 2022/23 will increase from 9% to 10.25% before returning to 9% in 2023/24.

From 2023/24 onward, all self employed will need to pay the 1.25% Levy as well as Income Tax and National Insurance.

Want to learn more about TidyCloud?

You'll find lots of helpful information in our information pack